Days cash on hand involves two components—daily operating expenses and cash on hand. For average daily expenses, one needs to subtract non-cash expenses from annual operating expenses. Businesses, whether https://www.instagram.com/bookstime_inc large enterprises or small retail organizations, are always vulnerable to contingencies, such as economic downturns, sudden financial crises, and market fluctuations. These challenges pose a constant threat to working capital erosion and lower liquidity even for businesses with substantial revenues or reserves. To ensure they can cover expenses and sustain daily operations, businesses must understand how much cash they would require to remain afloat without relying on additional revenue.

Steps To Calculate Days Cash On Hand Ratio

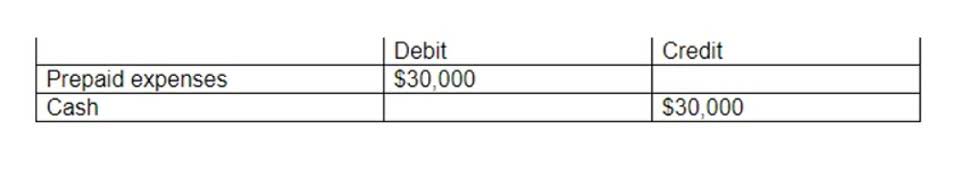

The total amount of purchases from the receipts ($45), plus the remaining cash in the box should total $75. As the receipts are reviewed, the box must be replenished for what was spent during the month. The journal entry to replenish the petty cash account will be as follows. Note that the entry to record replenishing the fund does not credit the Petty Cash account. We make entries to the Petty Cash account only when the fund is established or when the amount of the fund is changed or when the fund is closed and we want to add back cash in exchange for the petty cash vouchers.

Indirect Method vs. Direct Method

In contrast, if we give too little change of cash to customers that means it is a gain for us. Businesses can forecast cash into any category or entity on a daily, weekly, and monthly basis with up to 95% accuracy, perform what-if scenarios, and compare actuals vs. forecasted cash. If an employee fails to do so, you will show less cash than your records indicate you should have. This occurs because the original check is counted in a deposit, but the returned check is not subtracted from cash receipts. In this case, when we replenish the petty cash, we just need to refill $77 ($100 – $23) as we still have $23 remaining in petty cash.

- Credit, or decrease, your cash account by the amount by which you must replenish the petty cash account in the journal entry.

- The details about the cash flow of a company are available in its cash flow statement, which is part of a company’s quarterly and annual reports.

- Cash flow forms one of the most important parts of business operations and accounts for the total amount of money being transferred into and out of a business.

- If a cashier or bank teller errs by giving too much or too little change, for example, then the business will have a «cash short» or «cash over» position at the end of the day.

- Analyzing the trend over multiple time periods will offer a more accurate assessment of liquidity management and operational efficiency.

Examples of Post-Closing Entries in Accounting

Investors should be aware of these considerations when comparing the cash flow of different companies. Generally, the amounts in the account Cash Short and Over are so small that the account balance will be included with other insignificant amounts reported on the income statement as Other Expenses. The formula for the day’s cash-on-hand ratio is based on daily cash outflows, but that is not always the case for most of the businesses.

Cash Over Journal Entry

Automatically generate general ledger https://www.bookstime.com/ entries for bank transactions to ERP. For example, a monthly bank Fee of $5,000 is charged in the bank account, and someone in accounting will have to manually create the journal entries for that expense. The system automatically creates the GL entries based on user-defined accounting rules. It creates or uploads bulk cash transactions, eg-AP, AR, payroll, tax, etc.

Company

- It is not possible to operate without milk, and the normal shipment does not come from the supplier for another 48 hours.

- Automatically generate general ledger entries for bank transactions to ERP.

- If an employee fails to do so, you will show less cash than your records indicate you should have.

- We make entries to the Petty Cash account only when the fund is established or when the amount of the fund is changed or when the fund is closed and we want to add back cash in exchange for the petty cash vouchers.

- Find out if you have enough cash reserves with our Cash Flow Calculator.

- One way to control cash is for an organization to require that all payments be made by check.

- In contrast to investing and financing activities which may be one-time or sporadic revenue, the operating activities are core to the business and are recurring in nature.

During the day sales of 1,400 are entered into the register, and a cash count at the end of the day shows cash of 1,614 as summarized below. A cash over normally occurs in a retail accounting environment when the sales are reconciled to the cash receipts in the register at the end of the business day. If the cash in the register is more than the sales there is said to be a cash over. Likewise, if the cash is less than the sales the cash is said to be short.

Types of Cash Flow from Operating Activities

An automated cash forecasting solution offers scenario analysis software that helps create and tweak what-if scenarios over base forecasts and compare multiple scenarios with one another. They will have to borrow $50 million and use $50 million of their cash to do this. They want to is cash short and over an expense account know the effect on overall cash if they start the project next month (Scenario 1) or if the project is delayed 45 days due to bank approvals (Scenario 2).

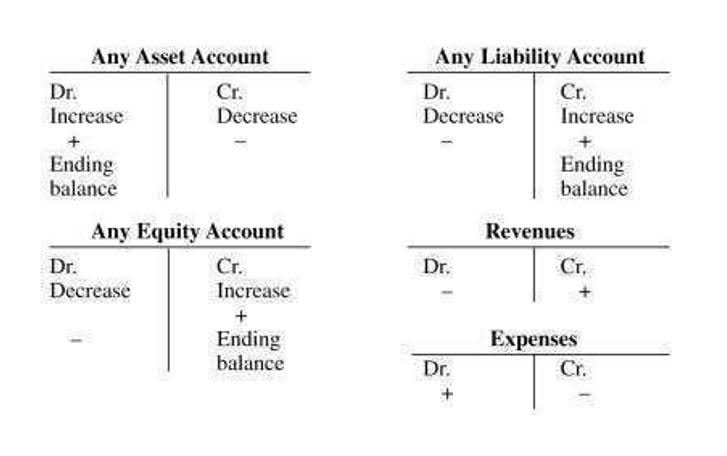

Double Entry Bookkeeping

Here is a video of the petty cash process and then we will review the steps in detail. In this case, we can make the journal entry to record the cash overage by debiting the cash account and crediting the cash over and short account and the sales revenue account. We make entries to the Petty Cash account only when the fund is established or when the amount of the fund is changed or when the fund is closed and we want to add back cash in exchange for the petty cash vouchers. To permit these cash disbursements and still maintain adequate control over cash, companies frequently establish a petty cash fund of a round figure such as $100 or $500. When the company has the cash overage in the petty cash fund, it can make the journal entry by debiting the expenses account and crediting the cash over and short account together with the cash account. In this journal entry, the credit of the cash account is to refill the petty cash fund to its full established petty fund.

For example, assuming that there is a $5 cash overage instead when we replenish the petty cash in example 2 above, which results in the petty cash reconciliation looking like the below table instead. A petty cash voucher is a document or form that shows the amount of and reason for a petty cash disbursement. This means that if there is more money than expected in your accounts, it will be recorded as an increase (debit) in this account; if there is less than expected, it will be recorded as a decrease (credit). For example, if a customer buys a $500 widget on credit, the sale has been made but the cash has not yet been received.