Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using ratio analysis objectives advantages and limitations simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

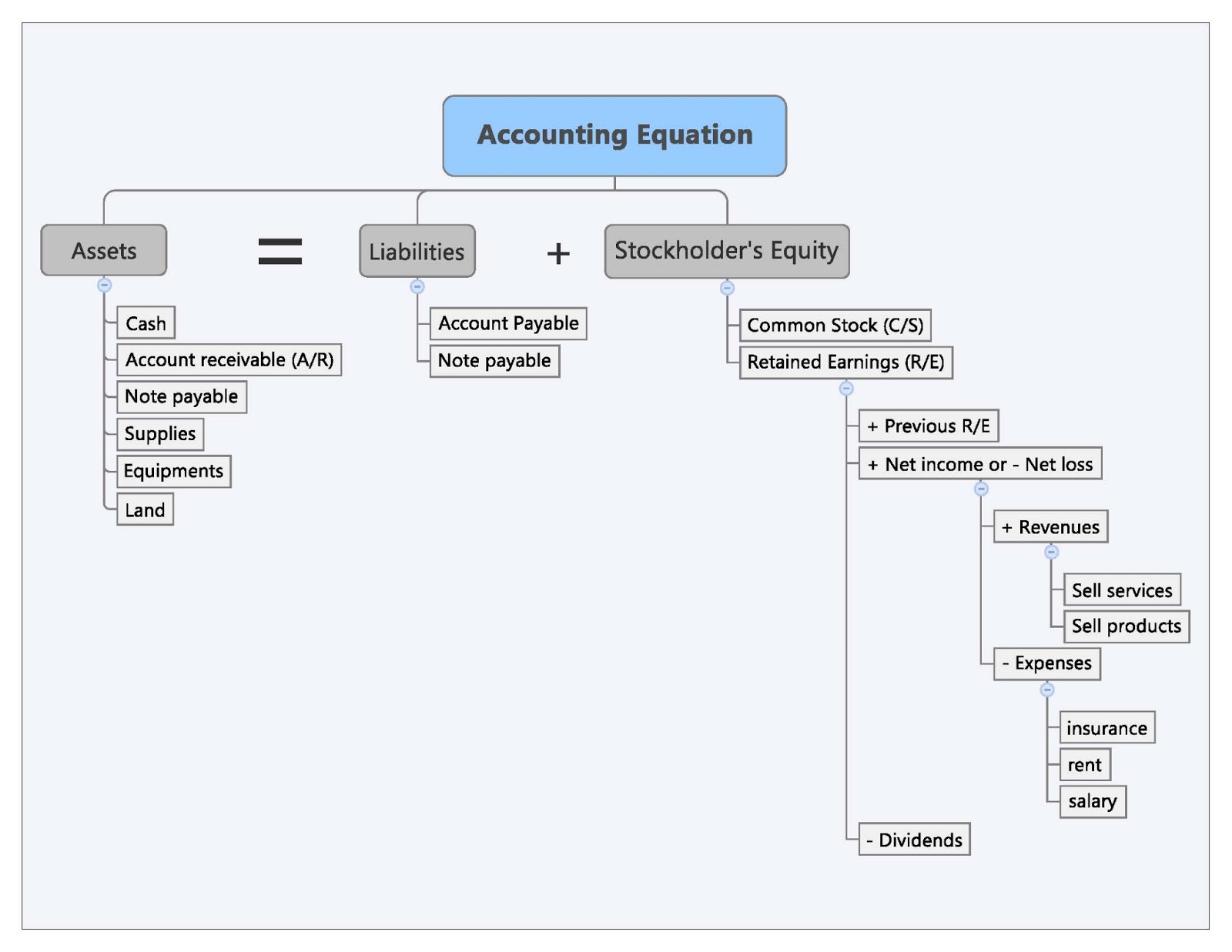

Assets, Liabilities, And Equity

If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability.

- As transactions occur within a business, the amounts of assets, liabilities, and owner’s equity change.

- The assets of the business will increase by $12,000 as a result of acquiring the van (asset) but will also decrease by an equal amount due to the payment of cash (asset).

- During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash.

- The accounting equation states that a company’s assets must be equal to the sum of its liabilities and equity on the balance sheet, at all times.

- Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

Effect of Transactions on the Accounting Equation

The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

What if any one of these elements changes?

It’s the compass that guides all accountants and bookkeepers, even if transactions get complex. For small businesses, knowing how the accounting equation works can help you better understand financial statements, along with how bookkeepers do their jobs. An accounting transaction is a business activity or event that causes a measurable change in the accounting equation.

For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance.

The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance. If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. The accounting equation is a core principle in the double-entry bookkeeping system, wherein each transaction must affect at a bare minimum two of the three accounts, i.e. a debit and credit entry.

The accounting equation is a vital concept in accounting, underpinning financial reporting and analysis. Understanding it is crucial for anyone involved in finance. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities.

It also represents the amount of paid-in capital and retained earnings as a result of doing business for profit. On 5 January, Sam purchases merchandise for $20,000 on credit. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets.

An error in transaction analysis could result in incorrect financial statements. The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded to represent the amount now owed to the supplier. Current liabilities are obligations that a company needs to settle within one year. Long-term liabilities are obligations that are due in more than one year, such as long-term loans and bonds payable. Understanding the difference between current and long-term liabilities helps in assessing a company’s short-term and long-term financial obligations. When the total assets of a business increase, then its total liabilities or owner’s equity also increase.

This arrangement is used to highlight the creditors instead of the owners. So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first. A lender will better understand if enough assets cover the potential debt. The accounting equation focuses on your balance sheet, which is a historical summary of your company, what you own, and what you owe.