Accounting software provides controls to ensure your trial balance is accurate. The software will ensure that the total dollar amount of debits equals the credit balance and that each account balance is in your trial balance report. Double-entry bookkeeping is an accounting method where each transaction is recorded in 2 or more accounts using debits and credits. A debit is made in at least one account and a credit is made in at least one other account.

- In general terms, it is a business interaction between economic entities, such as customers and businesses or vendors and businesses.

- This single-entry bookkeeping is a simple way of showing the flow of one account.

- Keep in mind that every account, whether it’s an asset, liability, or equity, will have both debit and credit entries.

- Every entry to an account requires a corresponding and opposite entry to a different account.

Both sides of the equation increase by $10,000, and the equation remains balanced. The purchase of furniture on credit for $2,500 from Fine Furniture is recorded on the debit side of the account (because furniture is an asset and is increasing). A batch of postings may include a large number of debits and credits, but the total of the debits must always equal the total of credits. When you receive the $780 worth of inventory for your business, your inventory increase by $780, and your account payable also increases by $780. The debit and credit sides of a ledger should always be equal in double-entry accounting. With double-entry bookkeeping, you’re tracking income and expenses in great detail, so you can clearly see where money is coming in and out of your business.

How Double-Entry Bookkeeping Works in a General Ledger

Single-entry accounting involves writing down all of your business’s transactions (revenues, expenses, payroll, etc.) in a single ledger. If you’re a freelancer or sole proprietor, you might already be using this system right now. It’s quick and easy—and that’s pretty much where the benefits of single-entry end. This reduces the balance of money in the bank or increases the overdraft. The balance of the bank account will eventually appear on the balance sheet.

Double-entry in accounting software

This double-entry system also means there’s less chance of fraudulent activity slipping through the cracks. For instance, if someone tries to inflate expenses or hide revenue, the imbalance in the records will flag the issue. This approach gives you the opportunity to investigate the situation and resolve it quickly before it becomes a bigger problem. If the bakery’s purchase was made with cash, a credit would be made to cash and a debit to asset, still resulting in a balance. In accounting, debit refers to an entry on the left side of an account ledger, and credit refers to an entry on the right side of an account ledger. With a double-entry system, credits are offset by debits in a general ledger or T-account.

Similarly, if you make a sale, the amount is credited to the sales account. It will eventually contribute to revenue in the profit and loss account. Very small, new businesses may be able to make do with single-entry bookkeeping. Public companies must use the double-entry bookkeeping system and follow any rules and methods outlined by GAAP or IFRS (the differences between the two standards are outlined in this article). Recording each transaction twice can be time-consuming, especially if you’re managing them manually. For small businesses and startups with limited resources, this extra time could take away from other important tasks, like serving customers or planning marketing campaigns.

Accounting entries

To illustrate how single-entry accounting works, say you pay $1,500 to attend a conference. In fact, a double-entry bookkeeping system is essential to any company with more than one employee or that has inventory, debts, or several accounts. So, if assets increase, liabilities must also increase so that both sides of the equation balance. Double-entry bookkeeping can appear complicated at first, but it’s easy to understand and use once the basic concepts have been learned. A bachelor’s degree in accounting can provide you with the necessary skills to start an entry-level role as an accountant. Double-entry provides a more complete, three-dimensional view of your finances than the single-entry method ever could.

Or, FreshBooks has a simple accounting solution for small business owners with no accounting background. Double-entry bookkeeping produces reports that allow investors, banks, and potential buyers to get an accurate and full picture of the financial health of your business. You invested $15,000 of your personal money to start your catering business. When you deposit $15,000 into your checking account, what are direct costs your cash increases by $15,000, and your equity increases by $15,000. When you pay for the domain, your advertising expense increases by $20, and your cash decreases by $20. When you receive the money, your cash increases by $9,500, and your loan liability increases by $9,500.

While double-entry bookkeeping helps detect errors, it doesn’t eliminate them entirely. Mistakes can still happen, especially if you’re entering transactions manually. For example, you might accidentally record the wrong amount, misclassify a transaction, or forget to enter both sides of an entry. These little errors can lead to time-consuming corrections in the future. Double-entry bookkeeping was developed in the mercantile period of Europe to help rationalize commercial transactions and make trade more efficient. It also helped merchants and bankers understand their costs and profits.

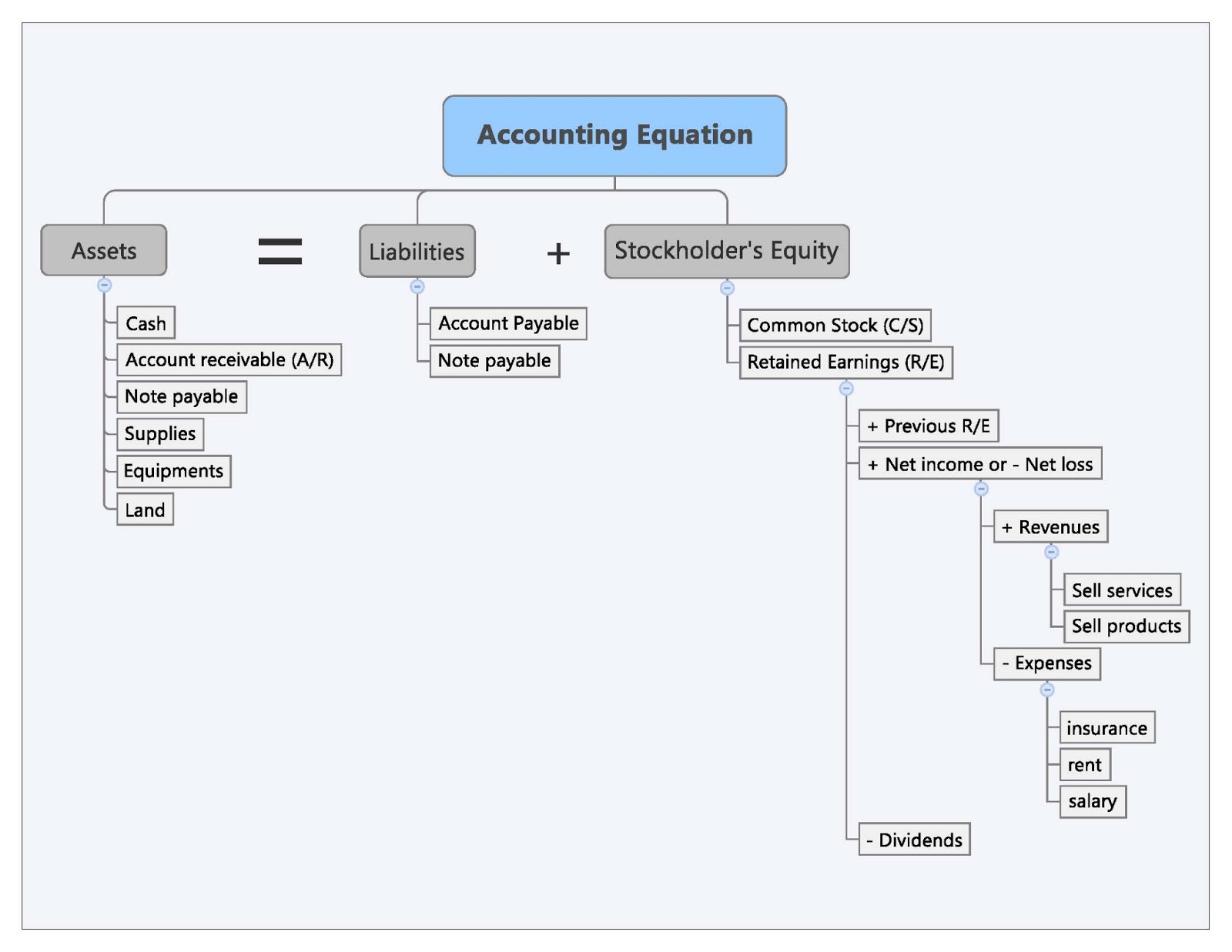

Linking each accounting entry to a source document is essential because the process helps the business owner justify each transaction. The balance sheet is based on the double-entry accounting system where the total assets of a company are equal to the total liabilities and shareholder equity. On the income statement, debits increase the balances in expense and loss accounts, while credits decrease their balances.