In my restaurant, I spent too much time trying to keep up with my daily, weekly and monthly bookwork and not nearly enough time using the information that came out of the bookkeeping. Although we only work with our clients part-time to meet their financial needs, we measure our success by their success. We take great pride in seeing our long-term clients grow their business year after year. With Bench, you get a team of real, expert bookkeepers in addition to software. You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials.

- Founded in 2020, Thompson’s Bookkeeping & Consulting serves as a resource and advisor for people of color and indigenous peoples who own a business in Lincoln and the surrounding areas.

- Whether you’re an individual, a small business owner, or a non-profit organization, we will work with you to provide the tax and accounting services you need.

- We believe non-profit organizations are valuable to society and we recognize their importance.

- We will get to know your business, the types of products or services you sell, what type of business you’re organized as, whether you have employees, and more.

Is a certified public accounting firm that is located in Lincoln, Nebraska. The firm offers tax planning, business startup services, income tax preparation, QuickBooks support and training, payroll setup and reporting, and assurance services. Demma Tax is a certified public accounting firm that is located in Lincoln, Nebraska and was originally inaugurated in May 1982. This firm offers tax consultation and preparation for corporations, partnerships, trusts and estates, and individuals. Services include financial statement presentation, bookkeeping services, payroll checks and returns, establishing accounting systems, and sales tax preparation.

T L Bookkeeping Assistants

We did so much so well but I also made so many rookie mistakes. Our expertise allows you to project future sales and business needs. We use Plaid, which lets you securely connect your financial accounts to Bench in seconds. This feature saves you the time and effort of manually uploading documents. Say goodbye to piles of paperwork and time-consuming manual tracking—we automate inputs directly from linked accounts.

- Services include bookkeeping, annual taxes, advanced tax work, and other additional services.

- No matter how far behind you are (yes, even years behind), we can get you caught up quickly.

- Is a certified public accounting firm that is located in Lincoln, Nebraska.

- To help clients maximize efficiency and profit margins, the firm provides services related to bookkeeping, payroll, tax planning and preparation, and business incorporation.

This reduces or eliminates overdrafts, late fees, and unnecessary interest charges when payments are late or missed. Accurate financial reports help your accountant minimize your tax liability and can reduce their cost since they won’t have to spend their time getting the books in order. Smartly plan for your business’s financial future with routine business consultations with Michael Jank. Whether you’re looking to start a new company or expand your current venture, he provides insightful advice tailored to your needs. We’ll work with you to connect accounts and pull the data we need to reconcile your books. We try our best to keep you with the bookkeeping team you’re assigned when you come on board.

The firm owner and founder, Perry L. Demma, obtained his certified public accountant certificate and permit to practice from the State of Nebraska in 1973. Ehlers Accounting & Tax Services PC operates in Lincoln and the surrounding areas. The company offers bookkeeping services, creating and maintaining charts of accounts that capture its clients’ financial transactions. Its professionals identify and resolve discrepancies through periodic internal audits. They also offer other accounting solutions, such as bank reconciliation, financial statement preparation, payroll, and individual consultation. Michelle Ehlers, a certified public accountant, has been in the industry since 1997.

Get fast, unlimited support from our expert advisors

It also offers website design, logo creation, and content management services. As a cloud-based firm, it can assist clients regardless of their location. Comprehensive Accounting Services is an accounting firm that is located in Lincoln, Nebraska and serves small businesses owners in the greater Lincoln, Nebraska area. It helps businesses owners who encounter increasing profitability, decreasing taxes, tax notices/surprises, or simply want more time. Comprehensive Accounting Services offers accounting, payroll service, tax service, bookkeeping, and business counseling. We believe non-profit organizations are valuable to society and we recognize their importance.

Welch Tax Service

Our team takes the time to deeply understand your business, answer your questions, help you link your accounts, and show you how Bench works. After working for ten years with Allstate Financial in a variety of capacities, I decided to pursue my lifelong dream of owning a restaurant. With a tremendous amount of support (financial and emotional) from my entire family, I opened Shadowbrook Salad Company in September 2007. After 13 months in business, I made the very difficult decision to shut the doors on my dream. The bottom line was that we simply started out way too big in an industry with ridiculously small profit margins. Those 13 months were both the most rewarding and challenging months of my life.

Find top Bookkeeping Services nearby

MJH, LLC is a certified public accounting firm that is located in Lincoln, Nebraska. Services include income tax and strategies, financial planning, bookkeeping solutions, payroll, and attestation services. Bookkeeping solutions include training, consulting, and bill pay service. The firm’s clients include Brown Church Development Group, https://accounting-services.net/bookkeeping-lincoln/ Icon Creative Group, Karas Dental, Changing Spaces SRS, Cross Financial Group, and Performance Aircraft. Its owner, Clinton Hlavaty, offers bookkeeping, accounting, and consulting services, helping clients grow their businesses. These solutions cover accounts payable and receivable, payroll, taxes, invoicing, and reconciliations.

Services for small businesses and individuals include income tax services of all types, bookkeeping, payroll preparation, and business advisory service. Burr Business Service employees are members of the Nebraska Society of Tax Professionals, National Society of Accountants, American Institute of Professional Bookkeepers, and more. Buckley & Sitzman, LLP is a certified public accounting firm that is located in Lincoln, Nebraska and was founded over 85 years ago. Partners Lester F. Buckley, CPA and Kyle L. Sitzman, CPA are members of the American Institute of Certified Public Accountants and the Nebraska Society of Certified Public Accountants. Founded in 2020, Thompson’s Bookkeeping & Consulting serves as a resource and advisor for people of color and indigenous peoples who own a business in Lincoln and the surrounding areas. To help clients maximize efficiency and profit margins, the firm provides services related to bookkeeping, payroll, tax planning and preparation, and business incorporation.

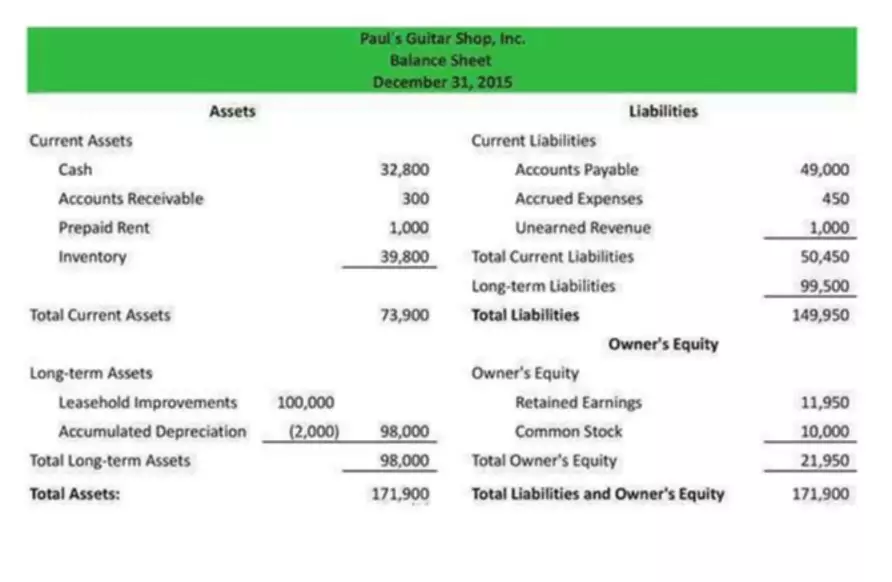

Once we have everything set up, we’ll complete a month of your bookkeeping in 1-2 days. Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books. The end result is a set of accurate financial statements—an income statement and a balance sheet.