Given that the budget is supposed to be prepared on the Accrual Basis, then it stands to reason that the financial statements should also be prepared on the Accrual Basis. Accounts payable and receivable are crucial aspects of managing an HOA’s finances. An HOA accounting software with efficient accounts payable and receivable management tools can help automate many of the manual processes involved in these tasks, saving time and reducing the risk of errors.

- And, if you have any experience with HOAs at all, you’d know that homeowners hate having to pay special assessments on top of their monthly dues.

- To help you we’ve put together this list of collections best practices for condo communities & HOAs.

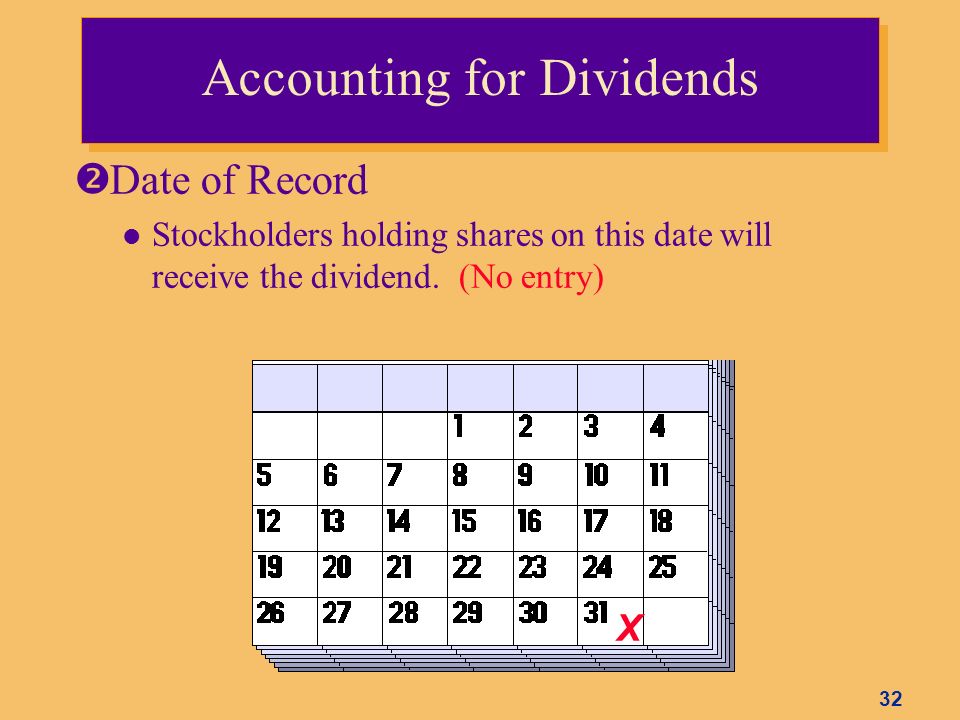

- Under the cash basis of accounting, revenue is recognized when cash is received; expenses are recorded when they are paid in cash.

- With the use of the Accrual Basis, you must prepare an Aged Assessments Receivable Report, a Prepaid Assessments Report, and an Accounts Payable Report.

- Once you collect payment from members (meaning actual cash is received), the “Cash” balance increases while “Assessments Receivable” decreases.

Invoices should then be entered into the accounting system, and checks would need to be issued by the accounts payable department. The treasurer of the association or the community manager would then review invoices or an open item payable report prior to authorizing signature. The community manager’s finance department should receive the bank statements and review the deposits and checks issued, to reconcile the cash position on a monthly basis. The primary function of the finance department is to achieve an accurate and consistent record of information on financial transactions of the organization. The financial statements and all supporting documentation should be given to the association’s directors for their review on a monthly basis. Under the accrual basis, all financial activities of your HOA are reported on the homeowners association’s financial statements.

Exploring the Best Accounting Method for HOAs

The objective sought in the control of cash receipts is to ensure that all cash due to the association is collected and recorded without loss or diminution. The system of controlling cash disbursements should be designed to ensure that no unauthorized payments are made. Control is accomplished by division of responsibility so as to achieve independent verification of the cash transactions without duplication of effort.

- Thus, it’s important for board members to understand which method the association will use.

- The system of controlling cash disbursements should be designed to ensure that no unauthorized payments are made.

- There are a few things an HOA should be keeping track of for bookkeeping purposes.

- This practice uses the Accrual Basis for reporting revenues and the Cash Basis for reporting expenses.

- Expenses are classified in income statements to help the reader grasp important operating cost relationships.

7.29 CIRAs may be required by state statutes or their governing documents to set aside funds on a systematic basis for future major repairs and replacements. The auditor should review the CIRA’s governing documents and relevant state statutes to determine whether such requirements exist. The auditor should also review the CIRA’s policy for accumulating the required funds. 3.02 A CIRA may be required to assess its members for future major repairs and replacements by statute, association documents, lenders’ requirements, or a decision of the board of directors supported by unit owners. From time to time, your homeowners association company will likely get together with homeowners to gather and discuss issues in your community.

The first report shows you a detailed list of owners who are in debt to the HOA, while the second report gives you a list of owners who have paid their assessments ahead of time. In contrast to the Cash Basis, the Accrual Basis records revenues and expenses as they happen, instead of when cash is exchanged. There are currently more than 370,000 homeowner associations in the United States, representing about 40 million households—more than half of owner-occupied homes! This year, the number of community associations is projected to increase 1.3% with 4,500 new communities expected, bringing the market revenue of the HOA industry to a whopping $33 billion.

How to Transition from Current Accounting

FrontSteps is a service that can be used to create and manage HOA websites. With this software, you can customize it to have many useful features such as violation tracking and online payments. This website makes it easy for residents in the community to file work orders. The management side lets you take care of your financial needs with their accounting services. Smartwebs accounting software was developed and designed exclusively for community associations, using the most up-to-date cloud technology and security. Powerful workflows, easy automation, and improved reporting will keep your HOA running smoothly.

“Homeowners’ Associations Bill of Rights” Law Takes Effect October … — JD Supra

“Homeowners’ Associations Bill of Rights” Law Takes Effect October ….

Posted: Wed, 26 Jul 2023 07:00:00 GMT [source]

Each accounting method comes with unique advantages with a different effect on HOA finances. Thus, it’s important for board members to understand which method the association will use. But, as an HOA board member, you should do your part to at least understand the basics of accounting and financial management. After all, even experienced professionals aren’t invulnerable to committing mistakes. By familiarizing yourself with accounting, you can safeguard your association’s finances. Simply put, an HOA audit is a comprehensive analysis of your association’s accounting records, including your financial statements.

This job can be complicated by inaccurate or incomplete financial reports. Poor reporting can make an already immense obligation harder to manage. Therefore, it’s important for all board members to know how to understand and analyze financial reports.

Get Financial Services for Your HOA Today

In addition, careful scrutiny of cash transactions is required because this asset may be readily misappropriated. Revenue is recognized when it is realized and expenses are recognized when incurred, without regard to time of receipt or payment. The focus of accrual accounting is on the realization of revenue, the incurrence of costs, and the matching of revenue realized and the cost expired. The American Institute of Certified Public Accountants is the professional organization of the practicing Certified Public Accountant (CPA). As a professional organization, the Institute has been vitally concerned with developing standards of practice, both ethical and professional, of its members. The “Journal of Accountancy” has been published monthly since 1905 as a forum for practicing CPA’s.

So, an HOA board can’t meet every day of the week or make sure that everyone’s paid their fees on time. This is especially true in larger neighborhoods with a lot of residents. Therefore, a lot of HOAs turn to a professional for HOA operational support. A professional will be able to help your HOA find vendors that won’t blow the budget. So, if they need to hire a yard service or pool maintenance crew, they can do that. This gives them the ability to help the HOA stay organized and prevent overspending.

In certain jurisdictions, condominiums may be established as condominium trusts; such entities may own the real estate and all the improvements. If they do, the accounting and reporting for condominium trusts are the same as for cooperatives. The term imprest cash refers to a fund of fixed amount used for making small expenditures that are most conveniently paid in cash. The imprest fund is restored to its original amount at frequent intervals by writing a check on the general bank account payable to Petty Cash. The replenishment check is equal in amount to the expenditures made from the fund.

The Complete Guide to HOA Accounting

Break down your expense accounts into more specific accounts such as “Legal Fees” and “Maintenance Supplies.” In doing so, you can more accurately track where your HOA’s money is going. Yet, Hoa accounting remains an integral part of your job as an HOA board member. The add-on also gives you the ability to import QFX, QBO, or OFX reports.

However, the amount of the unpaid invoices in the Accounts Payable Report, if provided, would not be on the Balance Sheet because these expenses are recorded on the Cash Basis, not the Accrual Basis. If you elect the Cash Basis, the amounts for Assessments Receivable, Prepaid Assessments, and Accounts Payable will not be reported on the Balance Sheet. As for why this is the case, the answer is that accounting provides both internal and external parties. Without accounting, it wouldn’t be an exaggeration to say making financial decisions would be the same as looking for the longest straw in a bale of hay in a lightless room. If you’re new to technology, you may be asking yourself what HOA accounting software is. Some homeowner’s associations find that maintaining their own personal financials as well as the neighborhood’s financials is too much for them.

Cattleack Barbeque in Farmers Branch sold to new owner — The Dallas Morning News

Cattleack Barbeque in Farmers Branch sold to new owner.

Posted: Thu, 17 Aug 2023 20:38:52 GMT [source]

In turn, these can help ensure you have enough funds available to keep the subdivision clean, safe, and comfortable. HOA accounting is an important aspect of running a homeowners association, but it can be a tedious task. Board members have a responsibility to understand financial interim statements to guide the association’s financial course.

Account Integrations

Based on these numbers, you can focus on problem areas and adjust accordingly. Whether that means raising the budget for lawn care, increasing assessments, or looking for a cheaper vendor is entirely up to you. Using this method, accounts like “Assessments Receivable” and “Prepaid Assessments” will appear on the Balance Sheet. However, liability accounts like “Accounts Payable” will continue to be absent.

This feature allows HOA members, board members, and financial managers to see the current balance of the HOA’s accounts, as well as any outstanding invoices or payments. Overall, HOA accounting software with efficient accounts payable and receivable management tools can help HOAs streamline their financial operations and reduce the risk of errors. By automating these tasks, HOAs can focus on other aspects of managing their community, such as communication with members, maintenance, and compliance. This software provides full-service accounting, from budgeting to bank reconciliations to monthly reports.

Condo Manager not only does accounting, but also offers website services, online resident portals, communication tools, and service request management that help to improve your association. 5.09 CIRAs that present interim financial statements commonly include comparisons with the budget to determine areas that require management’s action. Budget compliance is particularly significant for CIRAs, because users of their financial statements compare budgeted to actual amounts to evaluate the board’s fiscal responsibility. 3.05 The documents of some CIRAs authorize their boards of directors to fund major repairs or replacements by levying special assessments when the money is needed. Often, the documents require that special assessments be approved by votes of unit owners.

The fair and accurate reporting of the financial status and activities of the Homeowners association is the basis for accounting theory and practice. Therefore, financial statements and other reports prepared by the treasurer or accountants are vital to the successful working of the Community Association. Whether you’re in need of basic HOA accounting services or more, we make it possible like no other HOA property management company. Our advanced HOA management software makes it easier and more efficient to manage your Homeowners Associations accounting and reporting needs.

They can also send invoices or other documents electronically or physical copies via USPS using software automation. Likewise, volunteer managers have the ability to work remotely during hours they’re available and seamlessly communicate with residents. HOA boards often use general bookkeeping software like QuickBooks or Xero, or they may use even more basic tools like spreadsheets and paper ledgers. Get out your current service agreement and scan down until you get to the termination paragraph. Typically this paragraph states that the agreement can be broken a) for any reason with day written notice or b) immediately if “cause” such as negligence. Next up we’ll mail out a letter to all your vendors to change their billing address so invoices come to us.

It tells where the association stands with their asset, liability and reserves at a particular point in time. Finally, the Modified Accrual Basis (also known as Modified Cash Basis) is a combination of the first two methods. This practice uses the Accrual Basis for reporting revenues and the Cash Basis for reporting expenses. Like the Cash Basis, the Modified Accrual Basis doesn’t conform with GAAP. For this reason, you can only adopt this technique for interim or unofficial reporting.